Essential Ways to Compare Neighborhood Prices — Tips from St Charles County House Buyers

Essential Ways to Compare Neighborhood Prices — Tips from St Charles County House Buyers

Blog Article

Vital Tips for Every Property Purchaser to Browse the marketplace Successfully

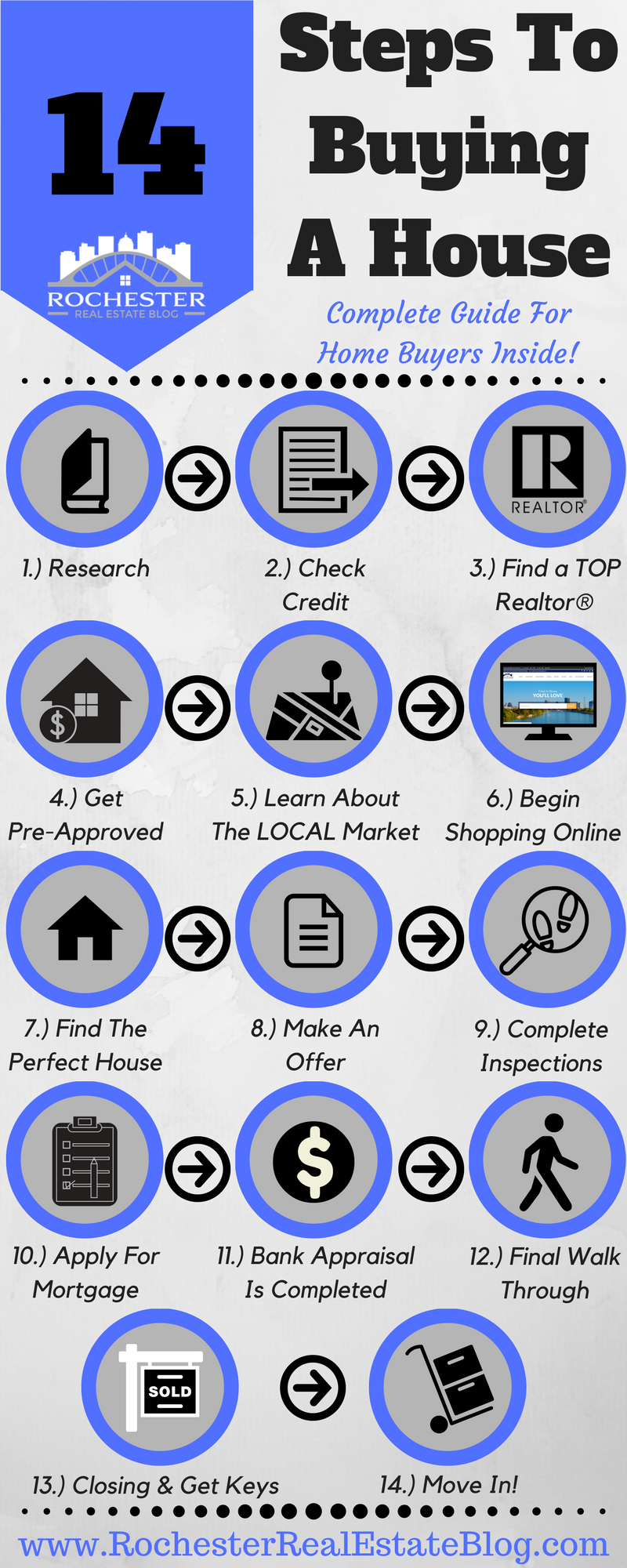

Navigating the property market can feel frustrating, yet it doesn't need to be. Comprehending your spending plan, understanding the regional market, and recognizing your top priorities are essential actions. You'll wish to work with a skilled agent that can offer beneficial understandings. Plus, being gotten ready for settlements can make a considerable difference. Exactly how do you obtain begun on this journey to discover your suitable property? Let's discover some important tips to help you succeed.

Understand Your Budget and Funding Alternatives

Prior to you plunge into the property market, it's critical to comprehend your spending plan and financing choices. Start by evaluating your funds, including your income, cost savings, and regular monthly costs. This'll assist you establish just how much you can afford for a deposit and regular monthly mortgage payments. Don't forget to account for added prices like property tax obligations, insurance coverage, and upkeep.

Take into consideration working with a financial consultant or home loan broker that can lead you via the process and aid you find the finest rates. Inevitably, knowing your budget plan and financing options encourages you to make informed choices, leading the way for a successful home-buying experience.

Study the Local Property Market

As soon as you have actually handled your spending plan and financing choices, it's time to dig into the regional real estate market. Begin by investigating current sales in your wanted areas to understand rates trends. Check out comparable residential or commercial properties-- these aid you evaluate what comparable homes are offering for and the length of time they're staying on the marketplace.

Use online sources and regional listings to obtain a feeling for what's available. Take notice of market problems, whether it's a buyer's or vendor's market, as this will impact your negotiation power. Do not overlook regional amenities, colleges, and future growth plans, as these elements can influence residential or commercial property worths.

Take into consideration getting in touch with a local property representative that knows the ins and outs of the area. They can give beneficial understandings and aid you browse the intricacies of the marketplace. Being educated will give you self-confidence as you progress in your home-buying trip.

Determine Your Must-Haves and Bargain Breakers

Before you start home searching, it's crucial to recognize your must-haves and offer breakers. Think of what functions are important for your lifestyle and which elements you simply can't jeopardize on. This clearness will simplify your search and assist you make informed choices.

Recognize Key Concerns

Just how can you ensure that your home-buying journey aligns with your demands? Beginning by determining your essential priorities. Make a listing of your must-haves, like the number of bed rooms, closeness to work, or exterior room. Consider what features improve your lifestyle-- possibly a contemporary kitchen or a home workplace. Next, consider bargain breakers. These are aspects you definitely can not jeopardize on, such as area or budget plan restraints. By clearing up these priorities, you'll streamline your search and avoid squandering time on buildings that don't fit. Keep in mind, this is a huge investment, so remaining concentrated on what genuinely matters to you will certainly help assure you find a home that fulfills your assumptions and way of living.

Identify Non-Negotiable Aspects

As you take part in the home-buying process, acknowledging your non-negotiable factors is vital for making informed decisions. Beginning by noting your must-haves, like the number of bedrooms, outside room, or distance to work and institutions. These aspects are important for your every day life and long-term joy in your new home. Next off, identify your bargain breakers-- features that would certainly make you leave a building, such as high crime prices, significant fixings required, or undesirable neighborhoods. Understanding these variables will streamline your search and prevent you from losing time on improper alternatives. Remain focused on your priorities, and don't be scared to leave if a home doesn't meet your essential standards. Your ideal home is available!

Deal with an Experienced Realty Representative

When you're prepared to acquire a home, partnering with a knowledgeable property agent can make all the difference - St Charles County House Buyers. They understand the regional market inside and out, which aids you discover the most effective listings and work out a large amount. Don't ignore the value of their knowledge-- it's your secret to a successful acquisition

Local Market Expertise

Locating the appropriate home can feel frustrating, especially if you do not understand the neighborhood market. A knowledgeable agent recognizes the subtleties of the neighborhood market, assisting you recognize homes that fulfill your demands and budget. By leveraging their knowledge, you'll browse the intricate market with confidence and discover the best place to call home.

Settlement Skills Issue

They understand the market dynamics and can advocate for you properly. Your representative knows exactly how to click over here now examine a property's worth, helping you make competitive deals without paying too much. Don't ignore the worth of a knowledgeable mediator; it might conserve you thousands and lead you to your dream home.

Accessibility to Listings

Just how can you guarantee you're seeing all the best properties on the market? They can offer you with information about residential or commercial properties prior to they struck the basic market, providing you a competitive side. Trusting a specialist's competence is indispensable in securing your desire home.

Be Prepared for Settlements

Although arrangements can feel challenging, being well-prepared can make all the difference in protecting the ideal deal on your new home. Beginning by investigating the marketplace to recognize comparable sales in the area. Understanding of current prices can give you take advantage of during discussions.

Next, recognize your budget and stick to it; knowing your limits assists you work out with confidence. Do not neglect to prioritize your must-haves and be versatile on much less vital elements.

Consider dealing with a skilled genuine estate representative who comprehends negotiation methods and can advocate for you. Practice your settlement abilities by role-playing with a close friend or household participant. This can aid you verbalize your points plainly and assertively.

Ultimately, approach arrangements with a favorable attitude. Structure connection with the vendor can result in a smoother procedure and perhaps much better terms (St Charles County House Buyers). Keep in mind, being prepared is vital to taking advantage of your negotiation experience

Conduct Thorough Residential Or Commercial Property Inspections

When you're prepared to make an offer on a home, performing detailed examinations is necessary to validate you're making an audio financial investment. Start by working with a qualified home assessor who can recognize prospective problems you might overlook. Search for indications of water damages, mold, or architectural issues that might cost you later on. Do not avoid the roof assessment; changing a roofing can be a significant cost.

If the residential or commercial property has a basement, check for moisture and foundation honesty. It's also wise to evaluate systems like plumbing, electrical, and heating and cooling to verify they're working go to website appropriately.

Take into consideration specialty evaluations, such as pest assessments or radon testing, particularly in locations susceptible to these issues. (St Charles County House Buyers)

Finally, depend on your instincts; if something really feels off, do not think twice to walk away. Complete assessments can conserve you from unexpected costs and offer you satisfaction regarding your investment.

Remain Informed Regarding Market Trends and Changes

After ensuring the building is sound via complete inspections, remaining informed concerning market fads and adjustments can significantly affect your buying choice. Markets change, and what you recognize can suggest the distinction between a good deal and a costly error. Watch on regional property records, adhere to relevant information, and utilize on-line resources to track home prices and neighborhood growths.

Networking with property representatives and attending open residences can supply understandings into present buyer sentiment and stock degrees. Comprehending rate of interest and economic indicators is also necessary; they affect your getting power and general market conditions.

Do not fail to remember to take advantage of social media teams or discussion forums where customers share experiences and recommendations. The more you recognize, the much more certain you'll feel when it's time to make an offer. Remaining notified empowers you to act swiftly and strategically, ensuring you find the very best residential or commercial property at the appropriate rate.

Often Asked Questions

What Should I Do if I Locate a Residential Or Commercial Property I Love?

If you discover a residential property you love, act swiftly! Schedule a watching, examine its problem, and research the area. Don't hesitate to make an offer if it really feels right-- trust your instincts at the same time.

The length of time Does the Home Buying Refine Usually Take?

Can I Acquisition a Home Without a Property Agent?

Yes, you can buy a home without a property agent. You'll need to investigate the market, take care of investigate this site settlements, and complete documents on your own, which can be challenging for first-time purchasers.

What Extra Costs Should I Anticipate Throughout the Acquiring Refine?

You need to expect additional costs like closing costs, home examinations, property tax obligations, home owners insurance coverage, and potential repairs. Don't ignore assessment charges and relocating costs, either. Budgeting for these will certainly help you avoid surprises later on.

How Can I Enhance My Credit Rating Before Getting a Home?

To improve your credit rating prior to buying a home, pay down existing financial obligations, make timely settlements, prevent brand-new credit questions, and examine your credit history record for errors. Consistency and diligence will generate positive outcomes.

Report this page